For the time being at least the worst seems to be behind us.

The global equity market (as defined by the MSCI All Country World Index) is up 13% from the lows, and now almost flat year to date.

Volatility1 has settled down as well.

So a moment of comparative calm then. As you know I believe wholeheartedly that we must adopt a “rules based” approach to investing at the outset, for the very reason that when difficult periods arrive we can remain stoic - confident that we have planned for such eventualities. During periods of high emotion, “winging it” just won’t cut it.

But when emotions subside, and things calm down - then what?

Well, it is now time to take a clear eyed and brutally honest look at how you have behaved as an investor these past few months.

If you were up to all hours checking what the Nikkei was doing, if your first thought every morning was to check your portfolio’s valuation, if a short-lived temporary decline in the value of your investments caused you to lose sleep - well one of two things has to change. Your portfolio strategy, or your mindset.

The first is easy, the second can be trickier. For while every time you successfully negotiate one of these declines improves your experience and gives you muscle memory to tap into next time around, as time goes by the value of your portfolio will also be increasing - therefore each new fall will represent a bigger value in pounds, shillings and pence. Which means, of course, it will naturally sting more.

Look nobody is a robot. It is ok to be uncomfortable or even frightened during these inevitable periods of difficulty, but it is the least we owe to ourselves to try and take whatever lessons we can moving forwards.

If adjustments need to be made now is the time to do it because, well, no-one knows if this recovery will stick.

As I mentioned above, we are now 13% off the April 8th low. So a decent rally.

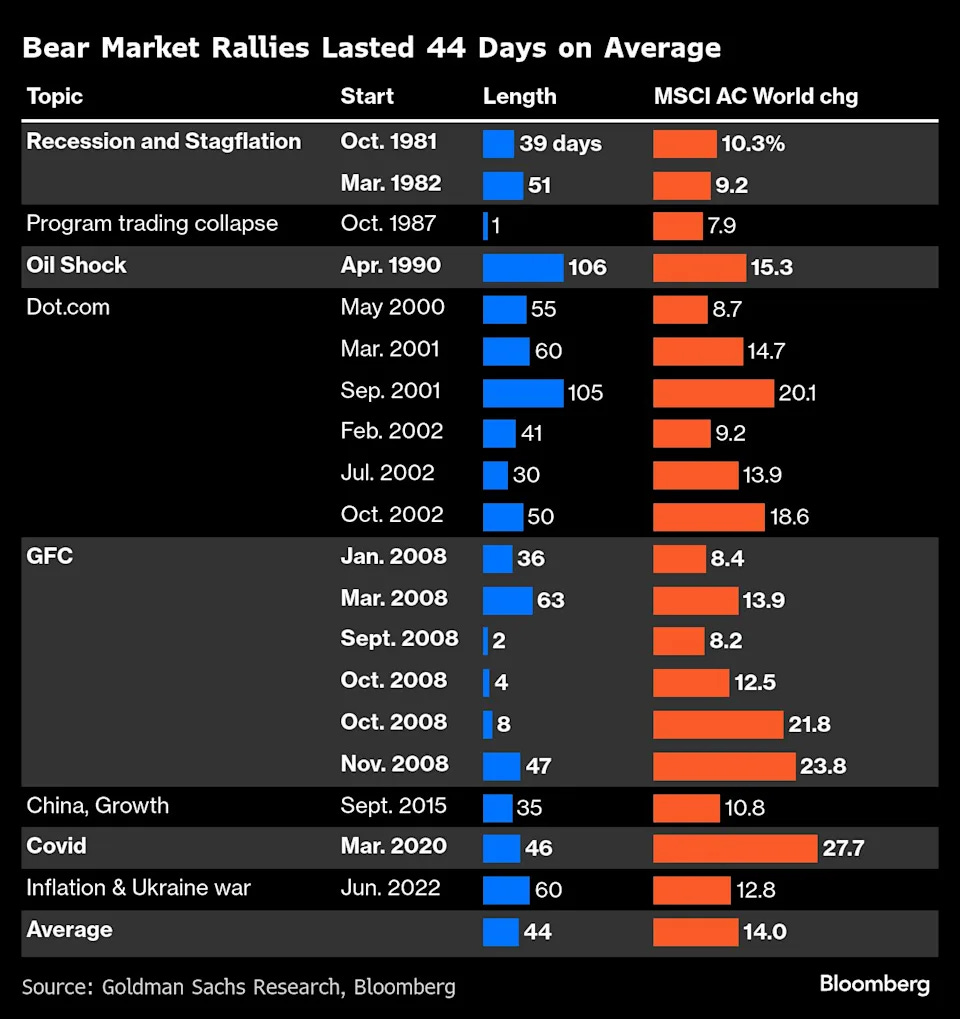

But better than decent rallies have failed in the past. The below table shows all of the bear market rallies2 since 1980 which eventually petered out and failed.

All of which is to say, don’t get your hopes up just yet.

One of the reasons that structural bear markets can be so heart breaking is that, to borrow from Al Pacino in the Godfather, just when you think you’re out - they pull you back in.

Rational optimism demands that we must always acknowledge that things may occasionally go a bit pear shaped in the short term. Surprise represents the mother of disaster for investors.

When I first drafted this post up on Sunday, my hunch was that this rally fails and we take out the April lows again. That looks less and less likely by the day now.

Regardless I am doing absolutely nothing different with my own money, or client money, based on whatever I happen to think day to day. Hunches aren’t tradeable and clients, friends, deserve better than guesses.

Have a great weekend.

Past performance is not indicative of future returns. None of the above is intended to constitute advice to any one individual. If you would like advice specific to your situation, please contact a regulated financial adviser.

The term volatility refers to the level of swings in prices over short time frames.

Typically, but not always, volatility increases when stocks fall in price. Hence the trope “stocks take the stairs up, but the lift down”.

A “bear market rally” is a recovery in stock markets that never manages to recapture the previous market high. When a “bear market rally” fails, the previous lows are revisited and usually crashed through.

Also referred to as a “sucker’s rally” - usually by people so clever they forget to make money.