At times of temporary drawdown, like we are in now, our innate bias towards activity can pull us toward doing something. Tinker, adjust, grab hold of the steering wheel.

But if we accept and believe that the key to investing success is to do as little as possible with our portfolios once they are suitably set up - then it can be helpful at times like this to have a means of “scratching the itch” in a low impact way.

Maybe tidy up our affairs a little, review the protection we have in place or look at how our cash is managed. In other words, make sure “the basics” are in order.

I’ve written before about how much cash any of us should have to hand at any given time. For some people, their circumstances and lifestyle will naturally mean that this number is far bigger than others - and as the numbers get larger, different solutions come into play.

In order of complexity (broadly speaking) the options for holding cash are:

Having a regular savings account with a commercial bank or NS&I1;

A Cash ISA;

Premium Bonds (not a fan);

Holding savings accounts with different banks through a single cash management platform; and

Low coupon gilts2.

Within this slate of options, I see low coupon gilts as offering a great alternative to a fixed rate savings account for higher rate and additional rate taxpayers. Let me show you why.

Let’s say I have a slab of money that I will need in eighteen months in October 2026. I could park this money in a savings account bearing interest at 4.6% at the moment, or I could invest the money into a gilt maturing in October next year.

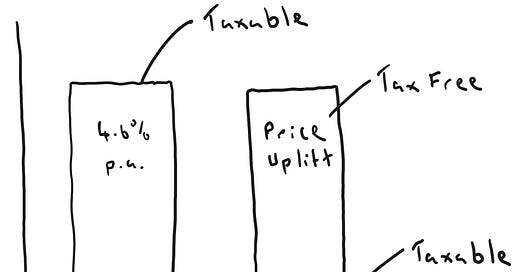

This October 2026 gilt pays a “coupon” or annual interest of 0.375% - which in isolation sounds deeply uninteresting. Particularly when you consider that the coupon is taxable.

But the cost of this particular gilt is currently £95.27, and (assuming the UK government remains solvent in the interim) in October next year you will get £100 back for each gilt you hold. Due to a quirk of UK tax law, this “uplift” is tax free.

The table below shows the impact of the different tax treatment. A higher rate taxpayer would receive a 23% higher return by investing in the gilt over eighteen months versus a simple cash savings account. The additional rate taxpayer would have seen a 33% uplift in return.3

Let’s be honest, the absolute numbers aren’t that exciting. But great financial management is about consistently making small sensible decisions. Actions compound in the same way as returns.

As I said at the get go, I think these gilts really come into their own when we are looking at higher or additional rate taxpayers with a known future liability to cover - a tax bill for example.

It is likely for this reason that the total yields for these lower coupon gilts have come down relative to the rest of the gilt market - folks have been getting wind.

Wealth managers love this trade. It is relatively simple sell with demonstrable upside and the costs to the firm are minimal. Open the account, hit buy and chill.

To be fair it isn’t a big earner either, but the bet they are making is that they can use these gilts as a “gateway drug” to full blown assets under management where the real margin lives.

This isn’t a criticism, it is just a fact. Incentives drive everything.

Anyway, that’s low coupon gilts. Great little trade for the right person.

Have a good weekend.

Beechgrove Financial Planning now offers cash management solutions to clients as part of our comprehensive wealth management service. If you would like to learn more, book in a call using the button below.

None of the above constitutes investment advice to any individual. If you have any questions regarding your individual situation then please consult a regulated financial adviser.

National Savings & Investment. As the NS&I are fully backstopped by the government, deposits held with them are not subject to the £85,000 Financial Services Compensation Scheme limit. This is the main attraction, because the rates on NS&I savings accounts are usually lower than high street equivalents.

For folks who sell a business, or have a big liquidity event, parking cash with the NS&I can be a great option. Not just because the funds will be “fully protected” - but also because you won’t have to field calls from private bankers at whatever bank trying to flog you their wares, when they see a chunk of change land in your account.

“Gilt” is the colloquial term given to debt issued by the UK government. When we buy a gilt, we lend money to the government which is repaid at a given point in time, along with interest.

I have assumed the cash account pays interest monthly, and that the higher rate taxpayer is able to avail of their “savings allowance” in full - paying no tax on the first £500 of interest generated on both the gilt and the cash deposit account.