(Some of) you have spoken! I am going to host a post Budget reaction webinar at 1pm on the 31st October. If you want to register, you can do so here.

It’s going to be short and to the point, but I will be setting out what I think are the main takeaways from the most anticipated Budget in ages along with any planning opportunities that I see. It would be great to have you along.

There are some rules of finance which appear entirely sacrosanct.

Spend less than you earn. Have some “rainy day” savings set aside. And avoid debt like the plague.

Undoubtedly, there are some folks for whom the final piece of advice is a very good idea. Our consumer culture demands that we spend more money now on “stuff that we don’t need, to impress people that we don’t like”1.

And it becomes all the easier to fulfil these base urges when we aren’t taking money out of our own pockets in the here and now, but pulling it forward from the future using credit.

Consumer credit levels in the UK have exploded higher since the 80’s. The average household in the UK today has £7,619 in unsecured personal debt, £2,350 of which is credit card debt.2

If we are spending using debt as a means of making ourselves feel better, or to feed our addictions - well clearly, that is a problem. Money Helper, Step Change and Citizens’ Advice offer great help to those in this position.

But if we accept the ability to borrow money as a tool in our financial armoury (and I believe that it is) - then that would imply that there are there situations when taking on debt isn’t just to be accepted but encouraged.

Buying a home

Even the most ardent critic of borrowing money would accept that taking out a (sensible) mortgage to buy a home isn’t a terrible financial decision. In fact, it is probably a necessity.

In 2023, just under 33% of property purchases were funded through cash alone3. That leaves a big old slug of people who are reliant on the banks.

Buying property can be a massive headache, and most of us are pretty bad at (honestly) accounting for the actual costs of property ownership. “She bought that place for x and sold it for y, what a genius”. Well Sharon, what about the stamp duty, interest costs on your mortgage and the time you had to get that handsome plumber out to fix the burst pipe?

We all have very selective memories.

But the point still stands that residential property in the UK has, on the whole, risen in value over time.

And if you are using debt to buy an asset that is rising in value, then you my friend get access to some sweet, sweet leverage4 to juice your return.

Mortgage debt can also help us to buy something that, without access to credit, would otherwise be totally unaffordable. People build their lives in their homes, and having a solid foundation for ten/twenty/thirty years can bring real security.

But, as ever, the key is to use debt sensibly. As we have seen in recent years, interest rates can go up and when they do UK property owners are disproportionately exposed versus those in other countries.

This is because our mortgage deals tend to be shorter in duration (two year fixes or five year fixes) than those in, say the US (where thirty year fixes are the norm). Because we have to re-finance more frequently, there is greater risk that interest rates move against us.

When a mortgage is the biggest fixed cost that you have, and for most of us it is, that can mean a big old dent in the monthly budget.

Interest free credit

If you have a decent credit rating, there are a lot of interest free credit card deals available out there.

Provided that you are using this money for something productive, say a home improvement or buying an asset that will generate any kind of return - doing so using 0% interest credit makes a lot of sense on the spreadsheet. Heck, you could take out credit at 0%, lob the money into a cash account paying 4% and as long as you can service the debt you pocket the difference.

However, taking on debt of this nature can reduce your future borrowing potential, so doing this kind of thing might not be a good idea if there is any chance that you might need to access some credit in a future emergency (and life has a habit of chucking curve balls).

Doing this kind of thing also demands a level of financial discipline. The bet that the credit card companies and the banks are making by offering these kinds of deals is that you will either forget to pay off or roll the debt onto another 0% deal by the end of the original term, therefore incurring interest at a punitive rate. You need to stay on top of when your deal ends.

Is the financial return you could make worth the administrative hassle?

Funding education

If we are talking about using debt to fund investment into a productive asset, what better asset could there be than ourselves?

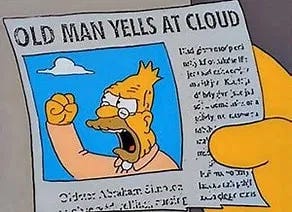

Although the cost of going to university is higher than it was in my day…

…the data show that investing in a university education is mostly a sensible financial decision. UK graduates earn £10,000 more annually on average than non-graduates.5

There are a number of misconceptions around student loans. The primary one being that the loan is repaid in the same way as any other loan. It isn’t.

Student loan repayments are only taken where the graduate earns over £25,000 a year and any loan amount still outstanding is written off 40 years after the initial payment. This makes student loan repayments more akin to a “graduate tax”.

For graduates going to university this year, although interest is applied to their student loans, it is applied at the rate of inflation (as determined by the Retail Price Index). Therefore the cost of the loan in real, inflation adjusted terms is neutral.

For parents sending little Johnny off to uni, using the funding available to the maximum extent that they can allows them to retain maximum flexibility within their own finances. And one would hope he might turn into a profitable investment when he has stopped drinking too much Jägermeister.

To build (or rebuild) a credit score

It may seem totally counterintuitive that taking on debt offers the means to show the banks that you are financially responsible, but it is a fact. A history of making steady repayments can contribute up to 35% of your total credit score.

In order to be comfortable lending larger sums of money, the banks need to be confident that you can handle borrowing smaller sums of money. Making use of a credit card, and paying it off in full each month, is good evidence of that.

I do exactly this every month with Amex to get the lovely points.

“A sharp knife is a good servant but a bad master”.

Attributed to various

For those in a precarious financial position, taking on debt is akin to chucking petrol onto a fire. It is incredibly dangerous, and lives have been destroyed by it.

Therefore it is imperative, even if you are in a good place financially, to understand fully the risks of what you are taking on. You have to stay on top of things administratively. The simpler your financial circumstances are - the easier it is to do this.

But used in the right hands, debt is just a tool. It can be a useful and productive method to help grow our wealth and ease demands on cashflow.

Like any tool, debt is neither good nor bad. There are just the right and the wrong hands.

Have a great weekend.

As ever, and especially so this week, none of the above constitutes advice to any individual. If you need help or advice around debt, the resources that I mentioned above are great - and my DMs are always open.

Attributed to Dave Ramsey, personal finance commentator in the US.

As of July 2023, per The Money Charity. Full disclosure, I expected these numbers to be higher.

Per the Land Registry.

A simple example. I put down £50k to buy a property for £250k. That property rises in value to £300k. I have doubled the value of my equity to £100k, despite a relatively meagre 20% rise in the value of the asset.

Institute of Fiscal Studies (IFS).