Nul Points

Despite a domestic economy that is outperforming (dismal) expectations, investors continue to ignore the UK stock market. Why?

First up, some housekeeping. I’ve had some feedback that people would prefer that I stuck to a set time to send new pieces out each week, and so this will be The Money Den’s new weekly home - Thursday lunchtime.

Publishing at this time gives me a bit of space to write a post on a Sunday and polish it through the week. It also gives you something to read if you are pretending to work on a Friday.

And with that, back to our regular programming.

A week ago, when the air was filled with Chris Rea and HR departments were busy surveying the wreckage of office Christmas parties up and down the country, the latest UK inflation report dropped and it was very good news for the Bank of England. The November Consumer Price Index (CPI) number came in below expectations at 3.9% year on year.

Although prices are still going up, they are going up a heck of a lot slower than they have been in recent memory, and the Bank of England’s official 2% inflation rate target is starting to come into view.

A lot of progress has been made on getting inflation down, and so far the economic damage taken to do so has been fairly limited. In previous cycles a recession has almost always been the price to pay in order to get inflation under control, and therefore the current state of affairs is somewhat unusual.

But then again we have had an unusual few years. Shattered supply chains, and rising fuel and food costs exacerbated by war were major factors in the runaway inflation that we saw last year.

Low interest rates didn’t cause these problems, and raising interest rates sure hasn’t solved them.

But whether the actions of the Bank of England have helped to curtail inflation or not, the country looks to be in a better spot economically than it was twelve months ago.

And yet sentiment around the UK stock market remains pretty depressed. The FTSE has barely budged on the year, while the global stock market (the MSCI All Country World Index) is up by 17% in Sterling terms.

Sadly this isn’t a one off. The UK market has been of declining relevance on the world stage for some years. During the 80’s and 90’s, the UK consistently represented more than 10% of the global stock market. Today it sits around 4%.

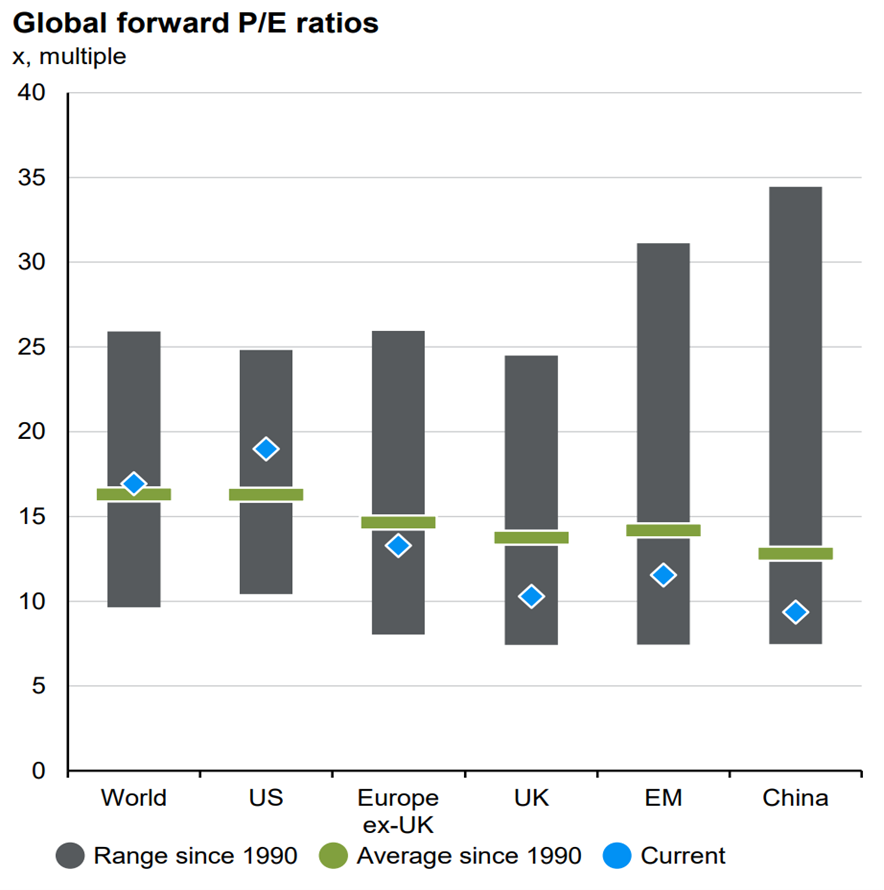

And investors continue to place lower valuations on UK shares relative to stocks listed elsewhere in the world. Again this is not just a recent phenomenon.

Source: IBES, LSEG Datastream, MSCI, S&P Global, J.P. Morgan’s Guide To The Markets Q3 2023

A price to earnings (P/E) ratio is simply a way of measuring how jazzed investors are about a company’s prospects. It is calculated by dividing a company’s share price by it’s earnings. A high price to earnings ratio tells you that investors are very excited about a company’s growth prospects, while a low price to earnings ratio implies the opposite.

Investors are definitely not excited about the prospects for small UK listed companies. Sentiment on the sector really doesn’t get much worse than it has been in recent months.

Source: Montanaro

Why do investors dislike the UK market so much?

Before looking at potential reasons why, first I’ll make two observations that you should always bear in mind when considering this topic.

Firstly, the companies that make up the FTSE 100 have almost no material link to the UK in an economic sense. Their earnings overwhelmingly come from outside of the UK and so a good, bad or indifferent economic outlook domestically is largely neither here nor there.

And second, while the political situation in the UK over the last decade has hardly been ideal, listed companies tend to do their thing in spite of, rather than because of who is in government.

Over the past decade the composition of the UK index has been a big headwind. We haven’t had enough of the right sort of companies (tech) and too many of the wrong sorts of companies (commodities/financials).

From the Financial Crisis to late 2021, the global economy chugged along slowly and inflation was almost non-existent (check out the first chart at the top again).

This is not a good environment for more cyclical sectors, like commodities and financials, that typically need a strong economy to do well. I don’t think it is a coincidence that when the low growth, low inflation trend reversed in 2022 that the UK index scored its first calendar year of outperformance versus the rest of the world since 2011.

While the composition of the index is undoubtedly a factor, in my view this all comes back to the power of incentives. To quote the now late, great Charlie Munger - “show me the incentives and I will show you the outcome”.

If you are a founder looking to float your company on a major stock exchange it is currently very easy to look past the UK. When you have serious amounts of money on the line, why would it be your first choice if you can achieve a materially higher valuation (and pay-out) with a listing elsewhere e.g. New York?

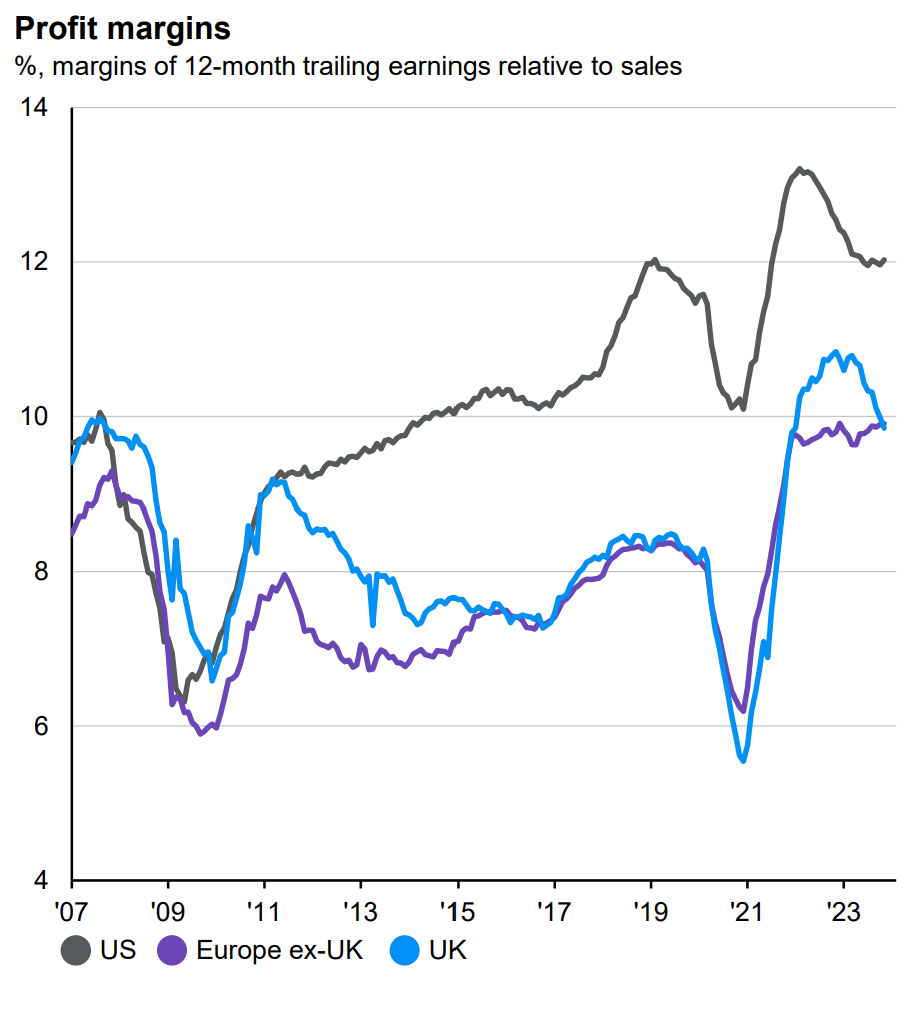

The best companies in the world just don’t list in the UK any more, they go to the States. Average margins for UK listed companies have consistently lagged those in the US since 2011 (when the oil price peaked and the commodity “super-cycle” ended).

Source: FTSE, LSEG Datastream, MSCI, S&P Global per J.P. Morgan’s Guide To The Markets Q3 2023

Without the best companies, the UK market will continue to trade at a discount and it’s weighting in the global stock market will continue to decline. Declining relevance, means lower valuations, means the UK’s weighting declines further.

It’s a death spiral.

How do we sort this out?

Your guess is as good as mine.

Potentially a good place to start would be to look at reducing the regulatory burden on companies listed in the UK, to bring them more into line with the rest of the world. In a similar vein, board level compensation in the UK is just not comparable with the likes of the US either.

However, the fact that the more lightly regulated junior AIM market has experienced valuation compression alongside the main London market in recent years would suggest that reducing regulation is not the be all and end all.

Ultimately, in order to get the UK market back into fashion we need to have more incentives for entrepreneurs to grow and keep their businesses here in the UK. No amount of fiddling with the tax rules will address the lack of relative quality available on the UK market for global investors.

There are green shoots on this front. The UK’s fintech sector is the second largest in the world and growing like a weed.

Why should I even care?

Because research tells us that the average unadvised investor is very likely to overweight to their home market.

A 2021 study by Quilter found evidence of persistent home country bias amongst UK retail investors – just under two thirds of investors surveyed had more than 25% of their portfolio invested in the UK, nearly half (46%) had more than 50% of their investments in the UK and around 8% claim to have all their eggs in the UK’s basket.

My hunch is that, in aggregate, UK stocks do pretty well from here. Starting valuation is an important input to returns, and as we have seen valuations today are undemanding. Domestically listed investment trusts are on mega discounts, and I reckon that there will be some real winners over the next few years*.

But there is no denying that having a home country bias has held back UK investors’ returns over the past decade. The next decade might look like the last one. Or it might not. Nonetheless, I am here to remind you that it is a big wide world out there.

There are over fifty major listed stock market indices worldwide, and it is impossible to tell which will be the best performing in any given year. Impossible.

The only way to guarantee being in the best performer each year, is to buy them all.

As ever, none of what I say constitutes investment advice, and past performance is not indicative of future returns.

*If you don’t know what investment trusts are, read on.

Investment trusts are companies which are listed on the UK stock exchange, which hold a number of shares in other companies within them. Think of them like a box of Quality Street, with lots of little chocolate shareholdings contained within.

As the investment trust itself trades on the stock exchange, we can compare its share value to the total value of all of the little shareholdings contained within it. At present sentiment around UK markets, and investment trusts specifically, is so bad that these vehicles are trading on historically wide discounts to the total implied value of the shares held within the trust.

If I haven’t explained this well enough, or if you have any questions, hit me up in the comments.